It was all about house prices again last week, with several different indices publishing their findings on the same day. Nationwide was first, showing that house prices were up 0.8 per cent in August; an 11 per cent increase on August 2013.

It was closely followed by the more accurate Land Registry data that, although a month behind, showed annual growth of 7.2 per cent in July. London was a mere 19.3 per cent up year-on-year.

It is interesting to note how the low interest rate environment is doing its usual thing and inflating house prices across the world, with a recent study in The Economist showing that in at least nine countries house prices are overvalued by 25 per cent, as measured by the ratio of prices to income per person after tax. It says Britain is at 24 per cent – one for discussion.

Meanwhile, the latest Help to Buy stats were revealed which showed 48,000 homeowners have used the scheme although the number of people using the guarantee scheme fell in June. They also reveal that 82 per cent of scheme completions have been made by first-time buyers, 94 per cent of Help to Buy completions took place outside London and the average house price was £187,800, significantly below the national average.

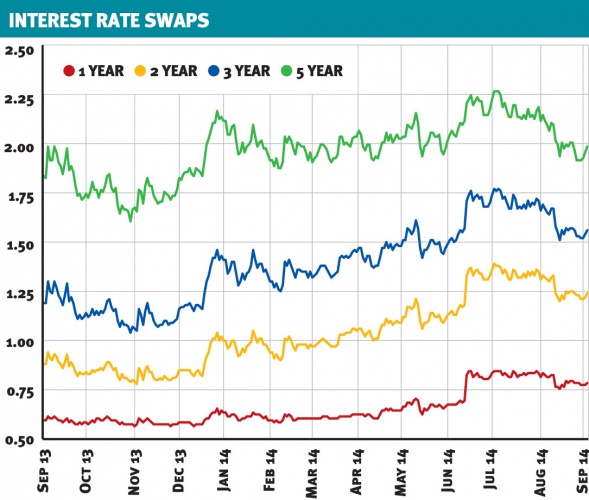

In the markets this week, three-month Libor was a touch lower at 0.561 per cent while swap rates have sheepishly staggered upwards.

1-year money is unchanged at 0.785%

2-year money is up 0.01 at 1.24%

3-year money is up 0.03 at 1.56 %

5-year money is up 0.07 at 1.985%

Product-wise, we have seen more activity, as you would expect now we are all back at school.

First off, though, Accord has become the latest lender to introduce the pointless, political loan-to-income cap for loans over £500,000. As with others, borrowers can now only borrow four times their income at this level.

Virgin Money has been busy and top marks for breaking through the 3 per cent barrier again and introducing a five-year fix at 2.99 per cent.

This is available at 60 per cent LTV and comes with a fee of £1,495. Its four-year fix is now reduced to 2.85 per cent with a £995 fee and a two-year fix at 1.94 per cent with a £1,995 fee.

It has also reduced rates by up to 0.30 per cent across selected buy-to-let deals, with two-year tracker rates available from 1.99 per cent with a 2.5 per cent fee.

Santander is also getting involved with cuts to products by up to 0.25 per cent and introducing a few new rates, including a five-year fix up to 75 per cent LTV priced at 3.54 per cent with a £995 fee. BTL products are also reducing by up to 0.26 per cent.

Clydesdale Bank will now look at buy-to-lets up to £1.5m and has two-year fixed rates available from 3.39 per cent with £2,999 fee.